"Context" is the word of the year. It is good to see that all the things I started writing about and teaching Kiki have filtered into the forefront of many peoples' consciousness. Trading in context is the difference between CP and not.

There are two seemingly identical setups on the bar chart. One becomes profitable and the other is a loser. The difference is the context, most of the time. That is why automated trading systems do not perform as well as a competent discretionary trader. It's almost impossible to program the context into an automated system. The result can still be a very profitable system, but should not be compared to discretionary trading.

The other big thing in the last year has been greater acceptance of SIM trading as a critical tool for learning, to perfect your trade without losing a ton of money while you do. To me, it has been a no brainer. Why would you not perfect EVERYTHING, except the feeling of risking your money, in SIM? No, it's not exactly the same as live trading but it almost is. And you then only have to resolve the one difference when you go live, after you KNOW that you can be consistently profitable.

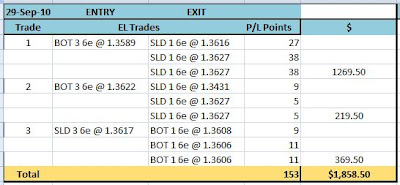

Trading the Euro FX again. This market is still going places. It had another pop this morning in London. And then it turned. It's important to keep listening. The overnight Profile provided the setup for the upmove. Price then broke back into value of both the overnight and the last distribution of yesterday, which had about equal VA. That was the clue to the breakout when the bar charts timed the entry. Same picture in a context that fit.

Tidak ada komentar:

Posting Komentar