The setup is everything. The right setup minimises risk. If you have minimum risk you can maximise profits. My whole philosophy on trading is evident in the posts to this blog. I have tried to drum these principles into Kiki much as my father drummed driving rules into me when I first learned to drive. He taught me to reduce my risk while driving, but to maximise my performance.

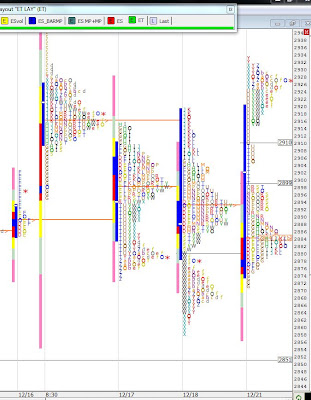

Monday finished on a firm note. The Market Profile looked like the first chart. There was a second distribution after a breakout.

The Range Bar chart showed the strong finish as you can see from the second chart below.

You can see the two moving averages getting further apart, the CVD is climbing making new highs, and the price had made a new high a few bars before the close. My pre-market work is to first look at the Profile and split it if necessary and determine the support and resistence. In this case it was quite easy. I split the second distribution and it looked like this:

You can see the new VAH of this distribution at about 2930. My idea would have been to look to buy the market at the VAH area if the order flow confirmed. And it did.

The place to have bought this was at the first pullback after the open at the VAH or even earlier as it bounced off the VAH at 2930. The long CCI was trending long, the EMAs too and the CVD still had buyers, the VB had the buyers stepping up. The long would have been at the close of the bar at 2938. Managing this trade could have been done in at least 2 ways. The first way would be the normal scale out @ plus 10 ticks and then look for reasons to exit the second and third pieces. In this case you would have sold at either 2940 or 2948 depending on which entry you made. You would certainly have been out of all of them @ 2944. The other way of managing would have been to exit the whole position in one piece due to the low volume Christmas markets. There are other combinations as well.

The setup had all the ingredients needed to go long with very little risk. The point of an entry is to give yourself a chance of making a profit. When you enter, you can have hypothetical targets but all you need is a very large opposite order for targets to become meaningless. So I scale out to bank profits as I go. The biggest problem is running out of bullets - I scale out too quickly and leave no positions when the market continues to move in my direction. That is why I use the market to tell me when to exit after the first scale and why I have developed re-entry techniques to be able to get back in, again with little risk, and profit by those trend moves.

Tidak ada komentar:

Posting Komentar