I had ES expectations for today that were not realised. The ES dipped overnight before London woke up. I tweeted that I tried to sell the early highs but the market didn't co-operate. I also tweeted that I would sell against 1279ish if the flow turned down. I ended up with a couple of OK trades as the vid shows, but the market didn't oblige and rather gave us the usual after a hard move down - consolidation.

Senin, 31 Januari 2011

Increasing the Margin

I had ES expectations for today that were not realised. The ES dipped overnight before London woke up. I tweeted that I tried to sell the early highs but the market didn't co-operate. I also tweeted that I would sell against 1279ish if the flow turned down. I ended up with a couple of OK trades as the vid shows, but the market didn't oblige and rather gave us the usual after a hard move down - consolidation.

Jumat, 28 Januari 2011

Steeler Nation Welcomes New Arrivals

By Mike Jones

By Mike JonesChartiers Valley Patch

Jan. 28, 2011

Little Brayden McQuillan was in the world for less than 10 minutes Friday morning when the staff at St. Clair Hospital wrapped him in a gold Terrible Towel and placed a Steelers knit hat on his tiny head.

“They’re born Steelers fans here in Pittsburgh,” said Sharon Johnson, clinical supervisor at the hospital’s Family Birth Center.

The staff at the hospital in Mt. Lebanon wrapped up 10 newborns in the towels Friday in celebration of the Steelers’ run to Super Bowl XLV. Each baby born this week at the hospital will also be wrapped up in the black and gold, a tradition the staff also did in 2008.

First-time dad Alexander Ameredes said his wife, Rachel, gave birth to their son Alexander on Wednesday, two weeks earlier than predicted. The Collier Township man said he thinks his son wanted to make sure he was around for the big game on Feb. 6.

“I was worried about the Super Bowl,” Ameredes said. “I think he was, too."

Where are the Customers' Boats?

Sadly, most of the customers don't have boats.

When I was on the floor, at the height of the boom when communism collapsed in Eastern Europe, I was trading about 2,500 contracts a day. As a local, I had very low clearing costs and there were a number of European and American clearers who competed for my business. Even at those low costs, my daily clearing costs amounted to between 25% and 30% of my daily profits. Making the move from wholesale to retail, I can't trade the same way as the costs of trading from upstairs are considerably more, even though costs have been pushed down hugely over the years.

I look at lots of trading systems and methods every year. I'm trying to find improvements and ideas just like everyone else. One thing that makes it difficult to assess the value of trading systems is the fact that often commissions are not included in trading results. I go to great lengths to make inquiries so I can factor the trading costs into results. When I succeed, I have often found that once you deduct commissions, the trading system or methodology doesn't really make money.

If you are trading large enough volume and want to obtain electronic exchange memberships then costs can be reduced. However, the costs for retail traders are much more. If you are trading 5 contracts say 4 or 5 times a day then you can get your costs down to between $3.80 and $4.20 on the emini. These costs MUST be factored into your trading plan. If your average profit per contract - taking into account every contract traded, winners, losers and scratched, is $4, then you are not making money. Your profit per contract has to be more than marginal.

I'll beat my win rate drum again. High win rate is critical to CP as otherwise you need very large profits on each of your winning trades. It's that simple. If you have, say, a 40% win rate, you also need to win the lotto once or twice a month with a super large profit to offset not only the many losing trades but the scratches and commissions on them all.

The issue is that you need to exit a trade only when you know it's a loser. Often, you can't know it's a loser until you have lost money on the trade. If your stop loss per trade (or average loss per losing trade) is, say, $125 per contract and your average profit per contract is $75, with a 70% win rate the maths of your business is:

On 100 contracts, $5250 won - $3750 lost - ($4 x 100) commission = $1100 Profit. BTW, the $400 commish is 36.4% of the profit. This is a little on the high side and needs to be brought down under 30% if possible.

There have been some comments and mails on this subject from people who have an issue because the result of their equation above is break even. The solution is in the numbers. Maybe its more aggressive entries, maybe its squeezing another tick out of your profitable exits and saving some ticks on your losing trades. If my maths is correct, the profit per contract in the above example is $11. Doesn't sound a lot does it. Now if you improve your entries or exits by just one tick on every trade your profit per contract is suddenly $23.50, more than double the previous profit figure. So instead of $1100 profit on your 100 trades, you are suddenly making $2350, a huge difference. What if you can improve by 2 ticks?

Today's trading was very cool in the afternoon. See the vid.

Kamis, 27 Januari 2011

An open message for Blue Origin.

There is a huge on-line discussion base about lower cost space flight and it clearly covers this and other B.O patents. If the patent is challenged the patent will be clearly invalid, but if it is issued it will cost millions to have it declared invalid. This is a huge expense to any small organization that might want to use that technology.

Addendum:

I am not anti patent, but the patent needs to actually be innovative.

I won't go line by line to refute the claims, that has already been done in several forums by myself and others.

If the patent actually had some new art, say:

- A unique way to adjust trajectory to compensate for performance changes and still land on the barge.

- A cool stabilization and retention system that would capture the rocket on a rolling barge and stabilize it.

- An innovative method to incorporate a flame trench or blast diffusion system on a barge.

- Anything that someone "Skilled" in the art would not find obvious to the extreme.

The CP Hump

Rabu, 26 Januari 2011

More Than Just a Yellow Dish Rag

By Mike Jones

By Mike JonesChartiers Valley Patch

Jan. 26, 2011

In the early 1990s when the Penguins were winning Cups and Pirates were still relevant, I tended to follow those teams rather than root for the downtrodden Pittsburgh Steelers.

They had won four Super Bowls a few years before I graced this Earth, but had fallen on tough times in the 1980s.

That all changed when Bill Cowher took the reins in 1992 and rejuvenated the team and catapulted it to a playoff berth against the Buffalo Bills. However, I still didn’t quite grasp what it meant to be a Steelers fan at the tender age of 9.

That is, until my mother handed me a yellow dish rag and told me to start waving it around.

“Are you crazy?” I asked her. “Why would I do that?"

It’s probably the same question people in Baltimore or New York or maybe even Green Bay ask themselves when they see those golden cloths twirling in the stands. But that was just about the time when I began to understand the lore of the Pittsburgh Steelers and The Terrible Towel.

Tips for creating a free business listing in Google Places: Adding useful descriptions and relevant categories

You will be asked to choose at least one category from our standard list - just start typing in the categories field to see what is available via the auto-suggestions.

We recommend always choosing the best matching and most specific category for your business - for any specific category, Google will be able to automatically determine the more generic category as well. That means, if you are a Mexican restaurant, you should go for ‘Mexican Restaurant’ and not ‘Restaurant’ - Google then automatically knows that if you are a Mexican restaurant, you are also a restaurant.

I'm sitting here, shouldn't I be doing something?

Today's vid shows an attempt at the Gap trade in the ES and then a change of mind and why.

Selasa, 25 Januari 2011

Google Boost: Now Appearing On Mobile Phones

EL in the Cloud

For those who are not too technical, there is a site here, that allows you to check how long it takes for your orders to hit the city where your broker's servers are located. When you access the site, your location is pinpointed. You just need to move the rectangle on the small lower map into the area where your broker is and then hover over the cities until you find the right one. After clicking on it, the broker city is selected and when you run the app you first get a "ping" number. My ping rate from France is between 123 and 144, too high. When I ping from Flo's new Cloud location I get 2 or even 1.

Great trade today in the Dow Euro 50. See the vid.

Senin, 24 Januari 2011

Google Apps for Business now available for Verizon customers

Most of Verizon’s service offerings are in the cloud and delivered to any business connected to the Internet with a click of the mouse. So it makes sense for us to offer Google Apps for Verizon to allow businesses to communicate and collaborate in the office or on the go.

Google Apps for Verizon – with three free user accounts – is available to business customers that subscribe to a bundle consisting of Verizon Internet service and either Verizon voice or TV service or both. Customers have the option to buy additional accounts. Also included is a domain name free for one year (i.e. yourbusiness.com).

Other small business essentials provided in Verizon’s bundled solutions include an easy do-it-yourself “kit” to develop your business’ professional website, Internet security, online backup, and more. Most importantly, we offer WiFi access – a necessity today to quickly respond to customers and access programs and files while out of the office.

Verizon’s business bundled solutions are available in parts of 12 states (CA, CT, DE, FL, MD, MA, NJ, NY, PA, RI, TX, and VA) and Washington, D.C. Those who just need Apps can subscribe to Google Apps for Verizon for $3.99/user/month.

To better help and inform small businesses, my team also developed the Verizon Small Business Center, a one-stop online portal with free resources, industry news, expert advice delivered through free webinars, networking opportunities, discounts, and much more. In combining these free resources with cloud products and services, we’re helping small businesses gain a competitive edge. Even the smallest companies now have access to technology that’s being used by larger businesses at minimal cost.

Google Apps for Verizon helps Verizon’s business customers harness the power of the web in new and exciting ways.

Something's Broken? Part 3

Jumat, 21 Januari 2011

Something's Broken? Part 2

Our big gift for small businesses

To kick off 2011, we wanted to thank a few small businesses for taking the first step toward enhancing their online presence—and to provide additional resources for achieving this goal. So over the holiday season, we paid a surprise visit to five small businesses who recently started advertising their businesses online: Create A Cook and Twinkle Star in Massachusetts, Ramy’s Garage and Atlas Flooring in Texas, and Cloud 9 Frozen Yogurt in Georgia. These small businesses span several industries, but their founders share one common goal: to expand beyond their brick-and-mortar storefronts and into the world of e-commerce.

To help, we gave them each of them $100,000 in AdWords spend for 2011 as well as free consultations with AdWords representatives. Because we know online presence means more than just AdWords, we’ll also be providing them with web consultations, wireless service for the year as well as a few other little surprises. See footage from our surprise visit below:

We’re looking forward to making big investments in small businesses far beyond these lucky five. Small businesses have long benefited from Google products and services; now our hope is that all small business owners can have greater access to the tools and training they need to develop a cohesive strategy for doing more business online. We started last year by creating the Google Small Business Center and asking small business owners about their biggest wishes for 2011. We received an overwhelming response from business owners who, like the owners of these shops, want to do more business online in 2011.

The Google Small Business Team surprises Atlas Flooring in Texas.

We’re thrilled to help these five small business owners find online success in 2011 and we think we have a lot to learn from their experiences. We’ll check in on them from time to time and report on their successes as well as their growing pains.

In the meantime, check the Google Small Business Blog for updates, and if you’re a business owner, visit the Google Small Business Center for information on how you can bring your business online in 2011.

Posted by James Croom, Product Marketing Manager, Google Small Business Team

Day at FAR...

We waited three hours for the delivery truck who thought the road was still to rough so we met him at the end of the pavement and took the delivery the rest of the way in our truck.

We then set up the test stand and fired the stainless DMLS motor. It was much better than last time, but we still have catalyst issues as we were not getting full decomposition. The beginning and end of the very long run were identical so we are no longer poisoning our cat packs.!!

I think I need to add some anti channel baffles.

The test stand worked flawlessly and set up to fire time was less than 45 minutes with just two of us.

After we finished that I went back and made another attempt on the generator:

I replaced ALL the banjo fitting seals and soft feed tubing. After doing that the prime pump was much more solid and priming was faster and seemed less random. The Motor still did not run.

Then I removed the side panel (Item D in the picture from two posts ago) and tried to figure out what moved when your moved the shutoff lever..... nothing moved.....

Then I removed the fittings and bolts holding block Item 9, from the top of the injection pump.

I discovered that the pump pistons have a little cam arm that comes out and engages a rod that should be moving. One of the injector pistons is stuck in the full up position and will not turn as it should. This jams the rod keeping all of the injector piston cams stuck in the shutoff position.

I freed that piston and reassembled everything.

Now when you move the shutoff lever you could see moment inside the area exposed by cover Item D. When the motor was turned over the outlets made little sequential squirts.!!!!

After fully reassembling everything the Generator started on the second attempt.

We then cleaned up the oily mess inside the generator enclosure from all the bleeding.

We buttoned up all the covers and ran it one more time. We now have a generator!!!!

Many thanks to Dave Weinshenker for the diesel help. He deduced what the problem was and provided me the information I needed to resolve the issue.

I should have data and possibly video of the rocket motor test in the next week some time.

I won't have much time this weekend as my Dad fell down and is in the hospital (Nothing major, he should be out Today) We also have a 99th birthday celebration for my Step Mom's mother this weekend.

Kamis, 20 Januari 2011

Something's Broken? Part 1

Losing days for inside-out trading are a result of sideways markets where the moves are not long enough to give a profit. In my course I teach traders to switch modes when they identify those markets and to trade outside-in. Identification is the issue because you need to know its chop before you lose too much. Whether you use EMAs or ADX or something else, being aware of market conditions is important.

The video of today's ES trading is based on Market Profile and shows how I use it. In addition to what I talk about in the video, the info from the range bar chart helps time the trades too.

Rabu, 19 Januari 2011

What a Business

So in constructing a TP, these are the things to also keep in mind. It's not very different to any other type of business in that respect. Can you imagine a business surviving if it only made profits on, say, 40% of it's sales and lost money on the other 60%?

Due to the way I envisioned today, I did NOT tweet the Gap trade. The market went down as I envisioned. I'm showing a 3 tick range bar chart today to show what I do when I want to see more or scalp. As it turned out, today this chart gave a much better entry into the ES shorts than the 5 or 6 range bar chart. Price did the right thing and hit my Fib line targets too. This is discretionary trading.

Selasa, 18 Januari 2011

Trading Every Day to Make a Living: Part 4

$ES_F Looking for resistance for the Gap trade at 1293/94 area. Blast past 94 invalidates. Jan. 18 at 11:05 AM

Senin, 17 Januari 2011

Trading Every Day to Make a Living: Part 3

There was a comment to Friday's part 2 post saying: "Your losers are three times as big as your winners so wouldn't the drawdowns (troughs) be large?" The annual maximum drawdown ran at less than $2,000 per contract traded as a fully automated basis and on a managed basis I estimated it to be half that. By using HT, the average losses are NOT three times as big as my winners. That's the point of HT. But even if they were, the high win rate makes the overall method profitable, as long as the winning trades are traded to a reasonable percentage of their potential.

Some trades I scratch straight away. For example, a long just below a strong resistance and that has the odds against the trade, I scratch. I manage my losing trades so as not to lose the whole drop dead stop. I typically have a drop dead stop of around $300/contract for the ES in case I need to double down. But I rarely use it. The market tells me to get out much earlier, but as it's different for every trade and not a fixed number, I can't as yet program all the possibilities. Also, using HT, I can add trades that Flo misses.

Beginning traders can start with a more robotic approach, having programmed stops and scaled out exits, and as their skill level improves with screen time, they can slowly take more hands on control.

For me, HT is definitely the best of both worlds.

Holiday in the U.S. I traded a bit of Euro futures in the London morning but taking the rest of the day off.

Jumat, 14 Januari 2011

Trading Every Day to Make a Living: Part 2

Kamis, 13 Januari 2011

Trading Every Day to Make a Living: Part 1

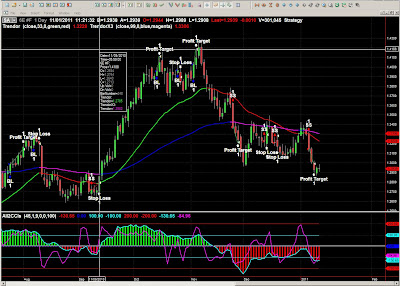

The chart today is of the Dow Eurostoxx50 that trades on Eurex. It shows how I used Flo to make entries and how I override the exits plus make additional entries. I have added some additional PaintBars so I can visual see some order flow details. The CYAN up arrows are additional manual entries and the RED down arrows are manual exits.

Rabu, 12 Januari 2011

Now available: Google Places with Hotpot for iPhone

We recently released Google Places with Hotpot in Google Maps for Android, and starting now, you can have that same great experience as an iPhone app. We realize the importance of finding places you’ll love while you’re out and about, no matter what mobile device you use. And Places with Hotpot not only helps you find places near where you are, it gives you the best places to go for you by personalizing your search results.

In case you aren’t familiar with Google Places, it lets you quickly search for places nearby and personalizes the results based on places you’ve rated. We get you started with a few popular search categories, but you can also tailor the list by adding your own favorite searches. This makes it fast and easy to find the best places for you with little fuss.

It can be pretty rewarding to discover a new place you love, but we also realize that there are some experiences you just can’t wait to share. So Places makes it super simple to rate a place with your iPhone while you’re there. Just fire up the app and hit “Rate now.” It will use your location to guess your current place and let you post a Hotpot review right from your phone. But it’s not just about getting to say what you think—the more you rate places, the more you’re sharing about your tastes and the more we can give you personally tailored recommendations.

If you want to make things even tastier, just visit google.com/hotpot from your desktop computer. Here you can add friends to the mix and quickly rate all the places you already know. Once you’ve added friends, you’ll find your results seasoned not just with reviews from around the web and recommendations based on your own personal taste, but also with your friends’ opinions too.

Get the Places app on your iPhone now by searching for Google Places in the App Store or going here.

This first version of Places is available for all iOS devices in English only. However, expect more features and improvements to roll out soon, including localization in many new languages. We’re hard at work to make Places with Hotpot more and more delicious.

Posted by Greg Blevins, Software Engineer, Google Hotpot team

Know when to Hold'em and Know when to Fold'em

The requirement for me is BELIEF. I can put my trades on and manage them because I BELIEVE, and I believe because I have back tested. Because I have back tested I can accept the risk, because I KNOW that I will be profitable over time. This is a 3 cornered chair; Testing, Belief and Acceptance. This makes for a stable trader's profile.

I'm working on some posts that show more of the maths that are involved in CP. There are a number of things to decide in order to create the necessary numbers. I'm hoping to have the first post of a series ready by tomorrow.

Today I tweeted:

$ES_F, My cup runeth over, nother Gap Trade setting up not much Res above so need to watch Order Flow & momoI put my money where my tweet was and went short about 15 minutes before the RTH open @1278.25. This is one of the trades we spend time on in the course. The DVDs have me trading a couple of them live and shows how to handle this trade, even when it doesn't quite go as planned. See the vid below.

Selasa, 11 Januari 2011

Introducing Google Engage for Agencies in US and UK

Are you a US or UK based Webmaster? WebDesigner? SEO? Marketing Consultant? Freelancer? or offering web related services to Small Medium Businesses? then keep on reading...

At Google, we’re committed to the success of the digital economy and we believe that helping small business get online and thrive is fundamental to that success.

We recognize that many SMBs rely on freelancers and small agencies to create and manage their online presence as well as help them with their online marketing. To make the jobs of these agencies easier, we’ve launched a new training and incentives program called Google Engage for Agencies.

Google Engage participants will receive free access to educational resources dedicated for them and more incentives to grow their own and their clients’ businesses.

We hope Engage will help businesses that offer web services in attracting new clients and in adding value to existing clients. Check out Google Engage today and learn about the benefits the program can offer your business and the SMBs you support.

If you’re a webmaster, web-designer, digital agency, freelancer, SEO, IT consultant, or provide any other web services to US or UK based small businesses, you can apply to join the program starting today.

Please see links below for information on participation for US and UK-based agencies:

Google Engage for US Businesses

Google Engage for UK Businesses

Posted by: Alon Chen & Esra Guler, Product Marketing

A Plan for tanks.

Clearly modern composite structures hold real promise for improving structural efficiency. I've dabbled in composite structures but I am very much a beginner. The tanks produced by professionals like Scorpius Launch Systems/Microcosm are both amazingly functional and beautiful. It would take me a decade to acquire that level of expertise. The recent composite coupons I tested for peroxide compatibility were fabricated by Microcosm/Scorpius. I'm currently riding home from a meeting at their facility where we finished the details of a joint development program to build peroxide compatible liner less tanks.

I think this is a win win for both parties Scorpius will get a new product line and we will gain access to world class tanks.

One Methodology, One Chart, Any Timeframe

Robustness means that I don't want the methodology to "not work". "Not work" is a fairly subjective measurement. I'm OK with a losing day and a losing week and perhaps a borderline losing month if I can see why. These are things that need to be addressed in back testing. Getting the right mix of trade frequency, risk and reward is very important, taking into account your own inputs such as available capital, risk tolerance, hours available to trade, time required by you to make decisions and more.

I use the same methodology for longer term trading and short term trading, as I have said before, but I choose the best instrument to trade it: future, ETF or option, depending upon the context. I was always determined to be responsible for my own investments after seeing the mess that agents made of other people's. I remember the quote from Woody Allen in "Midsummer Sex Comedy" where he said he was an investment advisor: "

In actual life, I help people with theirSadly, the quote is often true. The problem with investments managed by others is that you really don't have a handle on the risk aspect a la the flash crash. I like risk as long as the reward is commensurate. Where people get unstuck is when they get, say, a 12% annual return and suddenly lose 50% or more of their capital. Hard to make that up. On the other hand, everyone can't be an expert at everything so most people find a half way plan. I get trading ideas from all sorts of people and then choose what I think suits me.

investments until there's nothing left.

The Chart below of the daily Euro chart is a good example. Even the daily charts can be traded as HT or auto.

Today's trading was quiet in the London morning. One great trade and then a change of idea. I tweeted the Gap trade yet again. The Gap trade is one of my favourite trades, as you probably have gathered by now. For me, it's a really easy trade to put on and manage. It's also very easy to back test, so I can get it right. Look at the vid for today's action.

Senin, 10 Januari 2011

Expert Systems

Today at about 8.30am NY time I tweeted the Gap trade with a reminder to watch the zipper: $ES_F Gap trade possible but beware MP zipper dn to 1257.75 You can see in the video how I traded it.

Minggu, 09 Januari 2011

Measuring the Health of Your Business

Sabtu, 08 Januari 2011

Diesel frustration...

I sent the following note and picture to the vendor I bough the generator from. Any ideas from the peanut gallery? I realize the text is kind of rough, but it is part of an ongoing conversation....

I've attached a picture with parts labeled.

I still don't have it running, so I'll explain.

Today:

First thing I did was fix the return plumbing on top of the injectors.

I did not end up replacing the injectors as when I got the new bolts it all sealed up.

The return line that goes from the right end of the injector string down to the filter was rubber and leaking so I replaced it with the new metal part

I got from you guys.

Between each step below I'm loosening the screws #B and pumping the little pump until I get clear fuel with no bubbles.

I'm treating screw B like one treats a brake bleed, you need to close it while clear fluid is coming out so it does not suck in air.

So after fixing that and priming and bleeding I try to run... nothing.

The I remove the left most injector line nut #A (shown removed in the picture)

when I crank no fuel comes out the empty fitting, nothing not even a drop.

Then I remove all four nuts, and nothing not even a drop from ANY of them.

I open cover #3 and lift up the plate and turn the motor over to make sure gear inside is turning. It is.

So one of the guys says diesel pumps have shear pins and that could be it.

So I remove panel #D and turn over the motor, you can see the plungers moving up and down so the shear pin is probably good.

At this point I text you.

So for the next step I remove the screws #2 and then unscrew the left most two fittings #1 and the one to the left of it.

Inside are little plungers and springs, the plungers may have been stuck but the are now free.

Then I reinstall the springs and plungers and turn the motor over (after bleeding) and noting comes out.

So I remove #1 again and manually operate the prime pump and fuel comes out.

If I only screw #1 in part way the prime pump can make fuel come out. IF I screw it in all the way the prime pump can't

make fuel come out. If I only put number 1 into the point that the prime pump can make fuel come out and crank the motor No fuel comes out.

A couple of comments

The Hose #10 is really stiff and too big for the nipple, I really can't keep it from leaking air.

All of the banjo fittings on the inlet side of the world seem to have non metalic seals that are dried out and leak.

These were some of the seals I asked you for, but I've removed #10 and the banjo fitting behind it and all the fittings going to the first fuel filter,

I've brought these home and I'm going to get new seals and new hose before I go back out.

Some questions:

So at this point I'm lost? The only thing I see that could be wrong is that the inlet check valve into the plunger pump assembly is stuck open?

At this point is seems like I'm down to a fairly simple concept" plunger pump and two check valves.

Where will I find the inlet check valves to unjam?

Can I remove the whole upper pump assembly #9, if so do I just remove the 4 nuts, or do I have to do something else?

#J is fixed and I'm guessing it should not be adjusted?

#H moves all the way counter clockwise when you try to start, I'm guessing that that is the ONLY shutoff the electronics has for the motor?

#C What is this and does it do anything?

It takes be 4 to 4 1/2 hours each way to go the the site.

I've now been to the site 4 times to work on the generator. not counting time on the phone at home or asking researching at home

I've spent close to 50 hours working on this what should I do next?

Did you guys actually run this motor at your office? (based on the way it was packed I'd guess no.)

So realize this motor has NEVER EVER EVER run, so what else could be wrong?