The FinAngler Charters Investment Group is designed to raise capital to start a new niche charter fishing company in the Florida Keys. As a charter captain that truly loves the office I work in, I want to share the Florida Keys with my investors. That’s why I’m offering five free fishing trips per year to each of the investors.

Returns on investment are estimated at a respectable 25% per year over the three-year term of the investment. There is considerable potential to expand the fleet. With Cay Clubs having four locations in Marathon, to be fully operational by early 2008, a fleet of approximately eight backcountry boats is quite feasible. Other locations in Key Largo, Key West and Islamorada are potential areas for expansion. Cristal Clear Water sports will coordinate water sports concessions and charter bookings for Cay Clubs. Affiliation with Cristal Clear Water Sports will provide an exceptional pool of potential charter customers. See their website: http://www.CristalClearCharters.com

Typically, it takes three years for a charter business to become fully establish. The first year is slow. It really doesn’t matter how much advertising money you allot, returning customers and referrals from these customers, make the business. Properly placed ads, a well-built web site, affiliation with Cristal Clear Water Sports, and word of mouth advertising generated by the investor group, are adequate to generate the numbers listed in the following tables.

Five initial investors are desired. My intention is that these investors will provide the most valuable advertising any charter business can have, word of mouth. If each investor talks three friends into taking a single fishing vacation, seventy-five trips per year can be generated through free investor advertising.

The FinAngler Charters Investment Group isn’t designed to make any one super rich. It’s designed to let investors enjoy the fruits of their labors. To take a small fraction of what they have earned and develop a vacation getaway that makes money for them and lets them, and others, experience some of the finest fishing in the world. .

Captain Dallas

The Business Plan

Executive summary: Captain Dallas Tisdale. I’ve worked as a charter captain, guide and mate, in the Florida Keys since 2000. Prior to that, I’ve fished Florida for over thirty years, mainly recreationally, on my own boats. I started guide operations at Captain Pips Marina and Hideaways and helped start charter operations at Captain Pips Marina and Hideaways. While I have never cared for publicity, there is an article including me in Bass Masters magazine, February 1999, a small article in the Florida Sportsman, January 2000, and a number of newspaper articles in the Florida Times Union and the Weekly Fisherman.

My primary business consultant is Jim Dogherty, an inventor and co-owner in E P and R Corporation. Jim is a former customer that I unfortunately addicted to fishing. Had Jim not decided to open a barbecue joint in Galva, Illinois, he would be my primary investor.

After that mistake, (which his wife and I are still wondering what the hell he was thinking about), he is relegated to marketing.

Business Description: This is a Charter Fishing Enterprise. We are seeking to fill a niche between the high priced offshore charters and the flats fishing charters. Marathon offers some of the finest fishing in the world. Our charters are designed to show customers all the angling potential of the Marathon area.

Marketing Strategies: Our primary marketing strategy involves investors. Word of mouth advertising has and will remain to be the best advertising there is. Each investor is given five charter fishing trips per year to evaluate their investment. We expect three to five referrals per investor each year. With an average stay of five days per vacationer, approximately 75 trips per year will be booked through investor activity. Our affiliation with Cristal Clear Water Sports should provide an additional 75 trips a year. Customer referrals, proper directed marketing should produce an additional 75 trips. Sixty to eighty percent of customers return in following years. By the third year, minimal marketing is required to maintain a solid customer base.

Competitive Analysis:

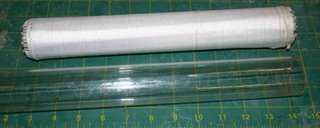

Big boat charters and the big cost associated with them, are over whelming the Marathon charter fleet. More big boats are on the way, greatly limiting the opportunities at this end of the charter spectrum. The mid-size boat charter fleet has been greatly reduced in the past three years. Smaller flats boat competition is limited to about 15 percent of the market during season due to the weather. We have selected to run fuel-efficient 26 foot boats that offer excellent adaptability to a variety of fishing applications out of Marathon.

The Game Plan: The first boat in the charter fleet has to be a success, or there isn’t a charter fleet. Start-up capital for first boat is just over $41,000.00. That pays for the boat and gives the business four months operating capital to get things going. With five investors talking things up and Cristal Clear Water Sports to book charters, this should be easy. Making sure that these first customers get quality fish and treatment is my job. I’m pretty good at it. I’ve been doing the charter thing for over seven years and I do know what I’m doing. I have to make sure that 98% of the customers talk good about the charter service. Word of mouth is where it’s at. Pardon my grammar, but it is. If a customer complains, that’s real bad!! So a captain has to go the extra yard to make the right stuff happen. I’ve been there and done that, no problem. Timing the start of the charter start up is somewhat important. An in season start greatly improves success. Off-season start up could strain capital reserves. Idea start up timing is December through February, March through May is reasonable, August, through October, is not recommended.

The Financial End:

In the table below, the total the half days, full days and tarpon trips, is 260 trips. Tarpon trips are run in the late evening or early morning, freeing the boat to run a half-day or full day charter on the same day. With these estimates, the boat will be operating, 180 to 200 days a year with paying customers. An additional 25 days a year are set-aside for investor incentive charters. Charter boats can easily operate 300 days per year in Marathon once established. This gives a comfortable margin of error to the following estimates.

Table 1 - Average Income and Expenses by Charter Type

Full Day Half Day Tarpon Trip

Expenses Expenses Expenses

Captain $150.00 $80.00 $60.00

Fuel&Oil $32.50 $20.00 $3.00

Bait&Ice $30.00 $15.00 $36.00

Tackle $10.00 $5.00 $5.00

Commissions/Discounts $82.50 $52.50 $48.75

Totals $305.00 $172.50 $152.75

Income Income Income

Trip Price $550.00 $350.00 $325.00

Gross Profit Per Trip $245.00 $177.50 $172.25

Trips Per Year 140 60 60

Gross Income $77,000.00 $21,000.00 $19,500.00

Annual Gross Profit $34,300.00 $10,650.00 $10,335.00

The following table list fixed expenses for operating the charter business. The advertising expense below, would be considered low if not for the Commissions / Discounts expense included in the previous table. Commissions will be paid to booking agencies and discounts will be offered to groups, like the military’s MWR program.

Table 2 – Fixed Annual Expenses

Fixed Annual

Expenses

Dockage $7,200.00

Insurance $2,500.00

Business License $250.00

Fishing License $600.00

Utilities $100.00

Advertising $2,500.00

Accounting $1,200.00

Management $7,200.00

Legal (incorp.) $600.00

Maintenance $1,000.00

Boat Depreciation $6,000.00

Total Fixed $29,150.00

Combining the data from table 1 and table 2, the gross income and profit estimates are as indicated below:

Gross annual Income $117,500.00

Gross profit Excluding Fixed Expenses $55,285.00

Gross Profit $26,135.00

Prior to distributions to investors, four months operating capital is to be retained by the charter business for off-season operating expenses. Again, this is being overly conservative. In the following years, retained earnings withholdings will be limited to replenishing this fund.

Retained Earnings

Dockage $2,400.00

Management $2,400.00

Accounting $400.00

Emergency $1,000.00

$6,200.00

The estimated average annual distribution to investors will vary over the three-year term of the investment. First year distributions are estimated at 50% of this average, second year at the average and third year at 150% of the average, as shown below:

Estimated distributions after Retained Earnings $19,935.00

Year 1 distrib. $9,967.50

Year 2 distrib. $19,935.00

Year 3 distrib $29,902.50

Total $59805.00

At the end of year three, the charter business will purchase the investor equity in the boat valued at $24,000.00, bringing the total investor distributions to $83,805.00.

Initial start-up capital requirements

Dockage $2,400.00

Boat $30,000.00

Sales Tax $1,625.00

Insurance $2,500.00

Business License $250.00

Fishing License $600.00

Utilities $33.33

Advertising $833.33

Book Keeping $400.00

Management $2,400.00

Legal (incorp) $600.00

$41,641.67

The start-up costs are the total capital investment requested of the investor group. Minimum estimated returns on that investment are $83,805.00. If better than estimated sales are achieved, profits over estimates will be distributed to investors.

With five investors, the minimum capital required per investor is $8330.00 with an estimated minimum return on investment of $16,760.00 over three years. A realistic maximum return on investment is $30,000.00 per investor.

Note: Since this original estimate was made, that availability of the base boat has changed. The boat that will be available will be approximately $3500 more than the original estimate. With the popularity of this style boat increasing daily, the cost of the boat could increase further. This is bad for start up, but potentially good in the long term as estimated depreciation should be much less than estimated. Actual data will depend upon costs at the time all investors agree. Initial start up capital required per investor upwardly estimated at $8950 based on five investors. To keep start up at this level, dockage cost will be reduced for the first two months of operation and management cost will be reduce by 50% for the first 3 months. No significant reduction in return on investment is anticipated, provided start up by January 1, 2007 is achieved.

Operations and Management Plan: For the first two boats, Captain Dallas can easily handle management of operations. Should an additional boat(s) be added, a receptionist may be required to answer calls and schedule trips. Sufficient funds are available in the financial plan to cover this cost. Maintenance schedules are very simple since all boats are new and under full warrantee. Minimal down time is expected for the boats. This is a huge advantage over the local competition.

Financial Factors:

No financial factors are anticipated other than those associated with expansion of the business. Boats can be added to the fleet as conditions allow. Each new boat will be considered a separate investment, with terms of investment equal to those stated for the initial boat. In this manner, each new investment, whether by an existing investor or a new investor, can expect the same term, return and incentives, as offered to original investors. Too rapid an expansion can adversely impact performance of the original boat(s). Additional boats will not be added until the original boat(s) exceed estimates sufficiently to ensure minimum estimated returns are achieved.

Off-season start up could strain start up capital. Should the total start up capital required not be available prior to June 1st, 2007, delaying start-up until November 1st, 2007, is recommended.

After the terms of each investment have been satisfied, 80% of the shares in the charter boat will revert to Captain Dallas Tisdale and 20% of the shares, will be retained by the original investor group. The free charters per investor will be reduced to two per year, with up to three more available at cost (just pay the captain). Investors may sell these shares to Captain Dallas Tisdale, or members of the investment group, at fair market value or retain their shares to offset costs of future fishing vacations. Sale of these shares to outside investors is not allowed.

In the event that income falls below estimates or other disputes should arise, investors shall agree to use third party arbitration to determine equitable resolution. The business structure, (limited partnership or chapter S corporation), shall be agreed upon by investors. Accounting oversight and year-end reports will be provided by a Certified Public Accountant paid by the charter business. To get the money here to start things, I’ll have to get the accountant to set up an escrow account, and all the paper work. He should be able to set everything up where nobody has to do a lot of traveling.

Any investment is subject to risk. This investment has been designed to minimize risk and add a little fun to the fund. If you take fishing vacations to the Florida Keys, you recognize the potential value of this investment. FinAngler Charters Investment Group is perfect if you love sport fishing and hate shoveling snow.

Thank you for considering

FinAngler Charters

Captain Dallas Tisdale

12/12/06-A small error was noted in the utilities expenses. That should read $600 not $100. The utilities expense is purely for business telephone service.

A question arose about credit card sales costs. This cost is included in the accounting fees and the percentage of sales charged by the credit card companies is include in the commissions and discounts.

Please note that commissions and discounts will not apply to all sales. Walk-ups, website sales and referrals from investors are not offered discounts unless required to close the deal on a trip.

Another question was raised about single investor financing versus five investor financing performance. With 5 investors, a realistic investor referral estimate is 75 trips. Eighty trips is the break even number required per year. With a single investor only 15 trips per year can be expected through investor referral. While roughly the same return on investment can be expected with single investor financing first year distributions are estimated at zero, with a potential first year loss anticipated. First year loss, second break even or small profit and third year profitability, is the standard growth curve for a charter start-up. Investor referrals are critical for first year profitability.

If you are interested in single investor financing, I have prepared a spread sheet revised for a standard start-up with typical plans for reducing first year costs.

Thank you,

Captain Dallas